A regular long-term performance

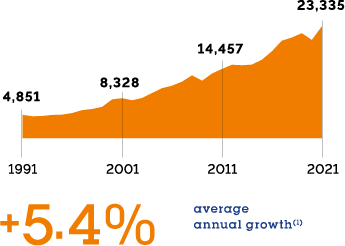

EVOLUTION OF GROUP REVENUE

over 30 years (in millions of euros)

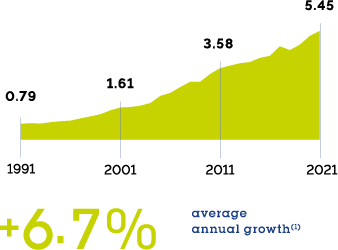

EVOLUTION OF ADJUSTED NET EARNINGS(2)PER SHARE

over 30 years (in euros)

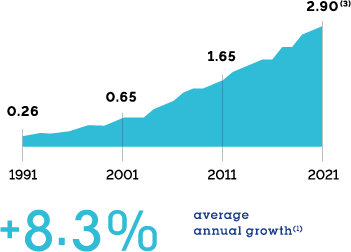

EVOLUTION OF ADJUSTED DIVIDEND(2) PER SHARE

over 30 years (in euros)

2021 key financial figures

REVENUE

€23 335 M

+ 8,2 %(4)

RECURRING NET PROFIT

(Group share)

€2 572 M

+ 13,3 %(5)

OPERATIONAL MARGIN

17,8%

+ 70 pbs(6)

EFFICIENCY GAINS

€430 M

GEARING

47,5 %

INVESTMENT DECISIONS

€3.6 bn

- Calculated according to prevailing rules over 30 years.<

- Adjusted for the 2-for-1 share split in 2007, for free shares attributions and for the capital increase completed in October 2016.

- 2021 dividend subject to the approval of shareholders at the General Meeting on May 4, 2022.

- On a comparable basis (excluding currency and energy effects).

- Excluding exceptional and significant operations not impacting operating income recurring.

- Excluding energy impact.