Reinventing proximity at a time of social distancing

The strength of your GroupThe strength of your Group

Since the very start of the health crisis, your Group has stepped up to ensure the continuation of its activities under the best possible conditions. Strong fundamentals have allowed it to withstand such events.

Over the years, your Group has already been faced with external crises. This year, its strength was demonstrated yet again thanks to very specific advantages.

Our regular, profitable and responsible growth model draws on a portfolio of essential products for life, matter and energy. These foundations will help build tomorrow’s world. Moreover, our presence at the heart of local economies in 78 countries and the diversity of the markets that we serve provide a particularly relevant complementarity to weather a global crisis. In addition to this, we can draw on the long-term, trust-based relationships with our partners and customers, as well as the well-proven adaptability of our teams.

Finally, we can rely on the trust-based relationship and the loyalty established with you, our shareholders, over many years. This is the basis of our long-term financial and strategic independence. This is essential for our highly capitalistic industry which requires major investment in research projects over several decades, as was the case for hydrogen. A mutual trust that was particularly visible in 2020.

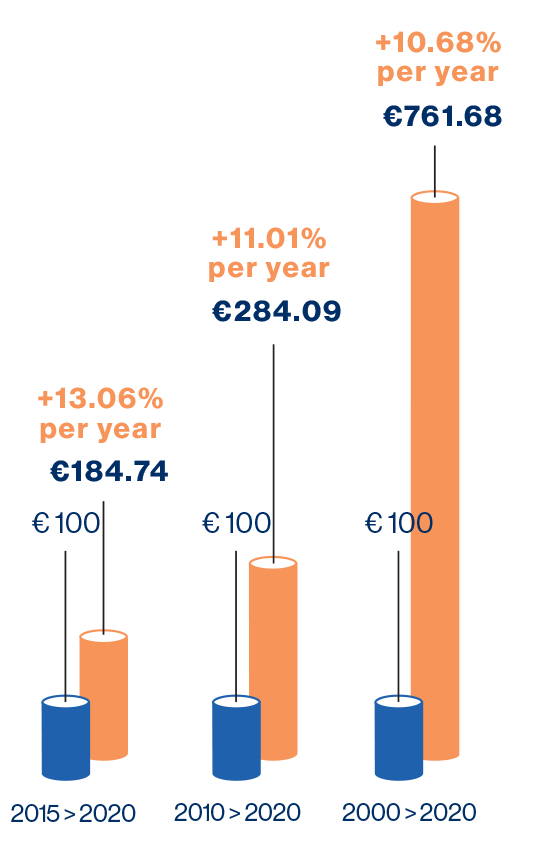

2015: €100

2020: €184.74

+13.06% per year

2010: €100

2020: €284.09

+11.01% per year

2000: €100

2020: €761.68

+10.68% per year

PORTFOLIO GROWTH

over the past 5, 10 and 20 years (TSR)

Value of portfolio at December 31, 2020 and average annual growth, before taxes.

The Total Shareholder Return (TSR) is an annualized rate of return for a shareholder who buys his shares at the beginning of the period and resells them at the end of the period. This calculation takes into account the evolution of the share price, the dividends reinvested in shares as well as the allocations of free shares, both increased by the loyalty bonus, and includes the impact related to the capital increase of 2016.

"The relationship with our shareholders is stronger than ever"

The year 2020 and its unprecedented crisis has once again underlined the confidence of our shareholders. There was no panic selling, some shareholders waited, others purchased new shares. At our end, we maintained our fundamentals and our commitments. We have, for example, decided to pay the planned dividend, despite the crisis. Contrary to common belief, this dividend payment supports the real economy, and often represents a retirement supplement for our shareholders.

Patrick Renard,

Director of Air Liquide Shareholder Services