As Patrick Renard, Director of Air Liquide Shareholder Services reminds us, “when the crisis broke out, the share price began to decrease and then rose again. But we were extremely impressed by our registered shareholders who remained loyal throughout the period”.

The Group, which has always been driven by the desire to involve its shareholders in its success, therefore maintained its traditional elements of shareholder compensation and recognition in 2020, in particular a dividend per share pf 2.70 euros, plus a loyalty bonus of +10% awarded to shareholders owning shares in registered form for at least two years.

Shareholding is changing!

54%

of new shareholders in France in 2020 are women. French shareholding saw a degree of renewal: more young people and women, with online management and mobile mediums. More independent and short-term focused, they are also open to other types of investment(1).

+10%

The loyalty bonus for registered

shareholders awarded to

shareholders owning shares

in registered form for at least

two years.

€2.75

per share. The amount of the

dividend proposed in 2021(2),

marking an increase of +1.9%

compared with the previous

fiscal year.

(1) Source: The French Individual Investors Observatory 2020, OpinionWay & F2IC survey - November 2020.

(2) Proposed for the 2020 fiscal year at the Annual General Meeting on May 4, 2021

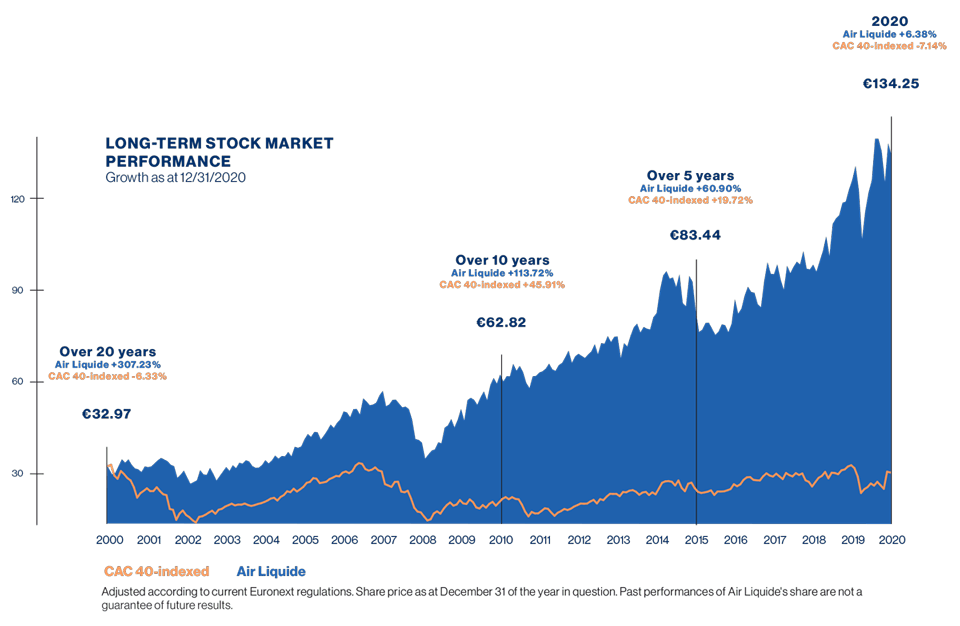

LONG-TERM STOCK MARKET PERFORMANCE

Growth as at 12/31/2020

2000

€32,97

Over 20 years

Air Liquide +307.23%

CAC 40-indexed -6,33%

2010

€62,82

Over 10 years

Air Liquide +113.72%

CAC 40-indexed +45.91%

2015

€83,44

Over 5 years

Air Liquide +60.90%

CAC 40-indexed +19.72%

2020

€134,25

In 2020

Air Liquide +6.38%

CAC 40-indexed -7.14%

Adjusted according to current Euronext regulations. Share price as at December 31 of the year in question. Past performances of Air Liquide's share are not a guarantee of future results.