Our advantage: solid long-term performance

Our advantage: solid long-term performance

In 2021, Air Liquide once again demonstrated its strength that comes from its fundamental advantages. Through the mobilization of its staff, on site or remotely, it maintained long-term relationships of trust with its partners and customers. It also benefited from the diversity and resilience of its business model. With operations in 75 countries and a presence in various markets and economic sectors, from everyday products to the aerospace sector, water management, healthcare, energy and electronics, the Group’s revenues by geographic area remain well-balanced.

Air Liquide has always strived to reconcile economic growth with respect for the environment and society as a whole. Through its actions and commitments, the Group contributes to the Sustainable Development Goals set by the United Nations. Its decarbonization solutions, particularly hydrogen, will play a major role in the development of a sustainable, low-carbon society.

The Group’s stability results in shares that outperform the CAC 40 over the long term and have, for 20 years, offered regular increases in price and dividends paid to Shareholders(1).

Additionally, the loyalty of our registered Shareholders is regularly rewarded with a loyalty bonus of +10% on the amount of dividends and on the number of bonus shares allocated.

€2.90

THE PROPOSED DIVIDEND PER SHARE IN 2022

+10%

THE LOYALTY BONUS FOR REGISTERED SHAREHOLDERS WHO HAVE HELD THEIR SHARES FOR MORE THAN TWO FULL CALENDAR YEARS

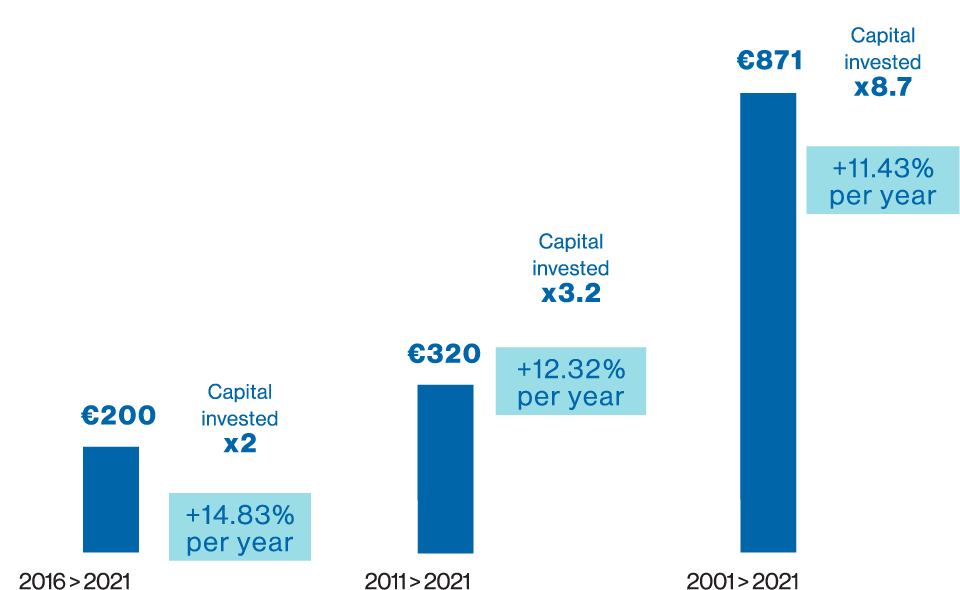

PORTFOLIO GROWTH

Over the past 5, 10 and 20 years (TSR)

Understand and calculate the profitability of your portfolio

Calculation based on the rate of return for a registered share(2).

- 2016 > 2021:

- €100

- €200: Capital invested x2, +14.83% per year

- 2011 > 2021 :

- €100

- €320: Capital invested x3.2, +12.32% per year

- 2001 > 2021 :

- €100

- €871: Capital invested x8.7, +11.43% per year

- Any investment in shares carries a risk of capital loss. Past performance of the Air Liquide share is no guarantee of future performance. This does not constitute financial investment advice. You may consult the risk factors mentioned in the Universal Registration Document.

- The total shareholder return (TSR) is an annualized rate of return for a shareholder who buys shares at the beginning of the period and sells them at the end of the period. The average return shown takes into account the change in share price, dividends reinvested in shares and bonus share grants (both increased for the loyalty bonus), and includes the impact related to the use of preferential subscription rights during the capital increase carried out in 2016 in connection with the acquisition of Airgas.