As far back as 20 years ago, my grandfather regularly declared that Air Liquide was a group with a future. Owning Air Liquide stock is a long-term investment. A safe bet.

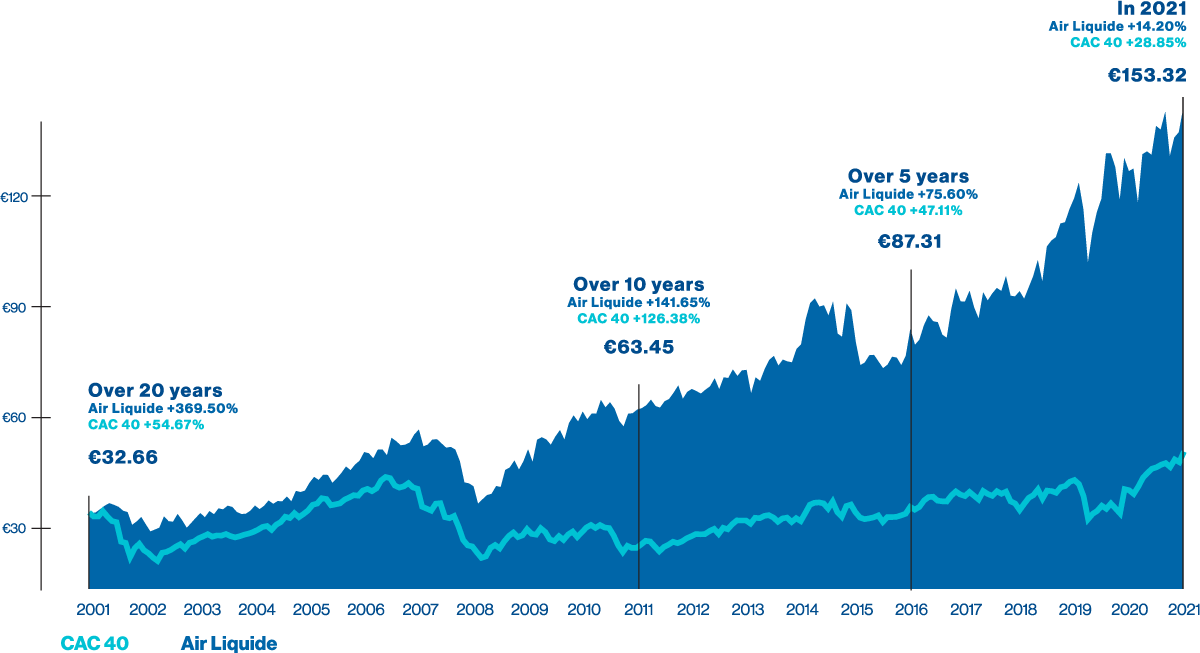

LONG-TERM STOCK MARKET PERFORMANCE

Growth as of December 31, 2021

Over 20 years

- Air Liquide +369.50%

- CAC 40 + 54.67%

- €32.66

Over 10 years

- Air Liquide +141.65%

- CAC 40 +126.38%

- €63.45

Over 5 years

- Air Liquide +75.60%

- CAC 40 +47.11%

- €87.3

In 2021

- Air Liquide +14.20%

- CAC 40 +28.85%

- €153.32

Adjusted according to the Euronext rules currently in force. Share price as at December 31st of the year concerned. Any investment in shares carries a risk of capital loss. Past performances of Air Liquide’s shares are not a guarantee of future results. This does not constitute financial investment advice. You may consult the risk factors mentioned in the Universal Registration Document.

Air Liquide is a pillar of French industry. Thanks to its high standards of professionalism, it has always been able to project itself into the future, especially by focusing on hydrogen to contribute to the energy transition.