Investing is a social commitment

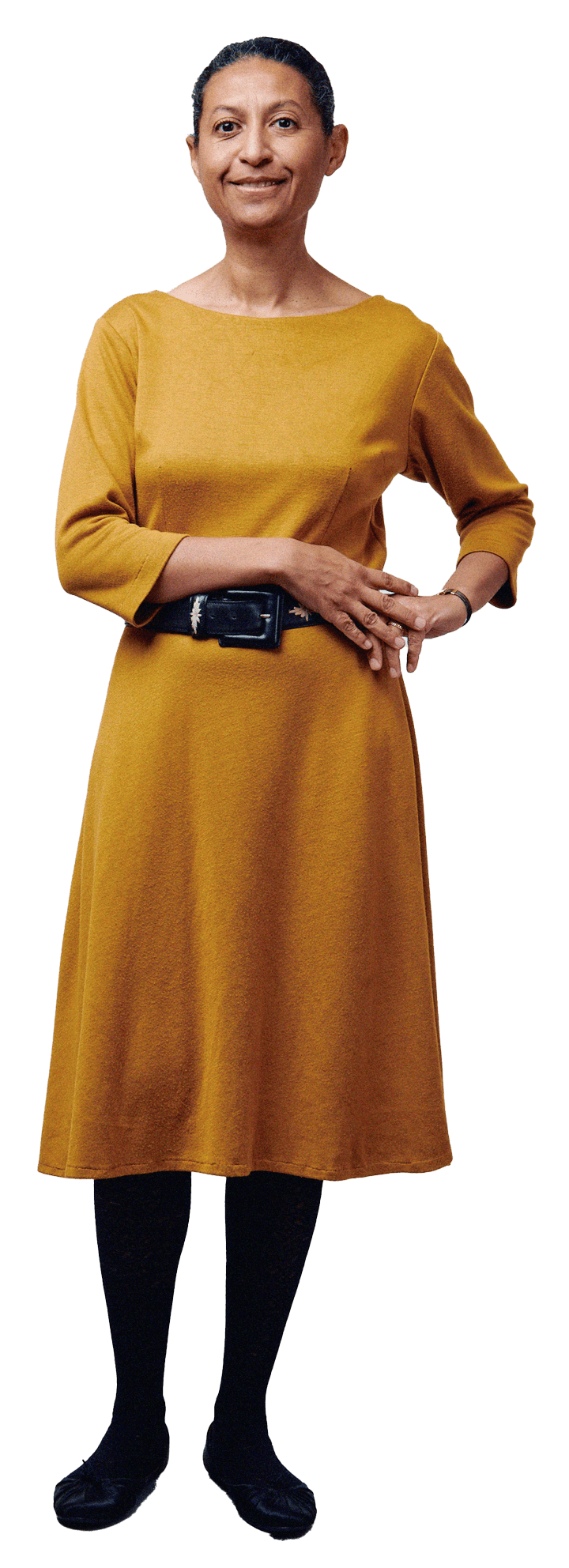

Virginie I.

An Air Liquide individual Shareholder since last year, founder of the association Coup de Pouce (A Helping Hand) and an active philanthropist.

A proponent of impact investing,(1) Virginie I. helps major investors choose investments that generate a positive social and environmental impact in addition to financial performance. This criteria led her to invest in Air Liquide.

Why did you choose to invest in Air Liquide?

Impact investing in companies like Air Liquide gives purpose to my investments. In addition to the financial return, which allows me to conduct an after-school project in the Haut-Katanga province of the Democratic Republic of the Congo, my Air Liquide shares are a way for me to support a company that is aligned with my beliefs. They are also an opportunity to contribute to the development of solutions that are beneficial to society and that meet daily needs, from transport and energy to healthcare and more.

In your opinion, what are Air Liquide’s strengths?

Air Liquide may be an international Group, but it values close relationships and favors direct contact with its Shareholders. I have great confidence in Air Liquide’s long-term vision, in part due to the stability of its strategy.

How do you get involved as a Shareholder?

Air Liquide provides many services and tools to Shareholders that are invaluable for answering our questions and helping us to feel involved in the Group. I follow Air Liquide’s news closely via the Shareholder Newsletter, which I read regularly, and via the website. I also get involved in events such as Génération Hydrogène, which explained hydrogen usages and its future potential. This involvement is essential to helping me understand the full extent of my investment.

(1) Impact investing is the practice of making investments in companies, organizations and funds that aim to generate a positive social and environmental impact in addition to a financial return.