Factsheet 12

Stock market essentials

A better understanding of financial markets.

12

The stock market enables private companies to raise financing from individual and institutional investors. It is also a place where supply and demand for financial securities are brought together.

Primary Market

When a company wishes to diversify its sources of financing, it may decide to raise funds on the stock market. It then decides to go public and issues shares for the first time on the stock market. Later, if it wishes to raise more funds on the stock market, it may launch a capital increase.

This type of financing is what’s known as the primary market, where investors who have confidence in a company’s ability to thrive finance it directly and receive shares in return. They then become shareholders in the company, or co-owners, and accept the associated risks and potential gains.

Secondary Market

Holders of shares, or shareholders, may sell their shares to other shareholders on the stock market. This matching of offer and demand for shares sets their stock market price at a given time and contributes to their continuous evolution. This is the “stock market price”, and it is said that the company is “listed on the stock market”.

This free exchange of shares constitutes the secondary market. It is only thanks to the secondary market that the primary market can exist: indeed, this ability to resell a share of ownership in the company created through the liquidity of shares is essential for guaranteeing initial investors (in the primary market) that they can resell their shares (on the secondary market) when they want to regain their investments.

The stock market therefore plays a key role within the economy, as:

- companies rely on it for a part of the capital required for their development;

- and shareholders directly finance this growth (primary market) and may later exchange their shares (secondary market), ensuring that this type of financing for companies can continue.

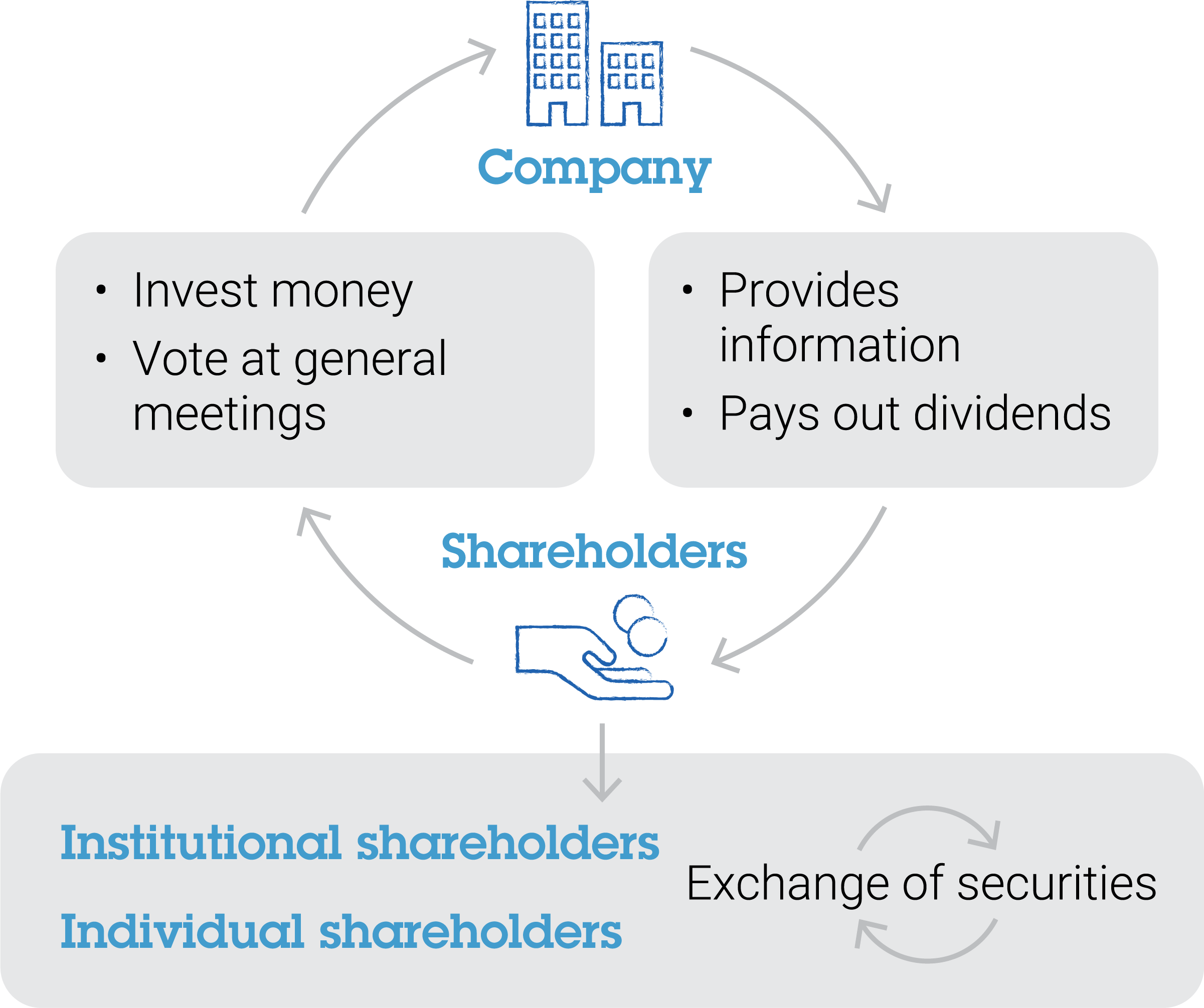

This diagram illustrates the process of investing money, voting at the general meetings, information dissemination, and dividend distribution to shareholders.

Shareholders invest money and vote at the general meetings; subsequently, the company provides information and pays out dividends to the shareholders.

There are two types of shareholders: institutional shareholders and individual shareholders, and securities exchanges are possible.

Figures: factsheet

Air Liquide share as of December 31, 2023

Continuous trading on EURONEXT Paris (Compartment A)

Security code: ISIN FR00-00120073

Par value: €5.50

Number of shares: 524,516,778

Market capitalisation: €92,378 million

Closing price: €176.12

Weight in the CAC 40 index: 5. 34%

Weighting in the EURO STOXX 50 index: 2.87%

Good to know...

THE CAC 40

The CAC 40 (Continuous Assisted Quotation or, in French, Cotation Assistée en Continu) is the benchmark index of the French market. It measures the share price performance of 40 companies on the Paris Stock Exchange. CAC 40 stocks are selected according to their market capitalization and their free float, i.e. the share of their capital open to the public and traded on the stock exchange.

As of December 31, 2023, Air Liquide had the sixth largest market capitalization of the CAC 40 index, with a market cap of 92,378 million euros and 100% free float.