Our project with Normand’Hy is a case in point. We are building the world’s largest electrolyzer, which will deliver low-carbon hydrogen to TotalEnergies’ Gonfreville refinery in Normandy (France) starting in 2026. We are also involved in the Porthos (Netherlands) and d’Artagnan (France) initiatives, which aim to accelerate CO2 capture and storage in Europe. As a key player in the energy transition, we offer our customers real decarbonization solutions spanning their entire value chain. We are part of the solution. You could even say that without us, there is no solution.

Another major development area for us is the electronics sector, which currently accounts for about 9% of our revenue and whose needs are increasing all the time, particularly with the rise of artificial intelligence (AI). Our US collaboration with Micron Technology, a leading semiconductor manufacturer, to supply critical gases to its future memory chip fabrication plant in Idado, is a prime example.

Also important will be our strategy of geographical expansion and regional densification approach, particularly in the United States and China. Air Liquide demonstrated the resilience of its diversified business model, which is based on the excellent fit between its different businesses and balanced geographical coverage. Since launching our ADVANCE plan, we have made more than 50 small and medium-sized acquisitions, particularly in distribution, to bolster our presence across the entire gas production value chain. One of our great strengths is the balance that we strike between our activities and business bases.

We have launched an in-house transformation program to enhance our capacity to seize major opportunities and lay the groundwork for the Group’s future. Among other things, we have streamlined our organization to speed up decision taking and enhance our operating efficiency.

The Group has always conducted a policy of building loyalty among individual Shareholders. What are the benefits of such a relationship?

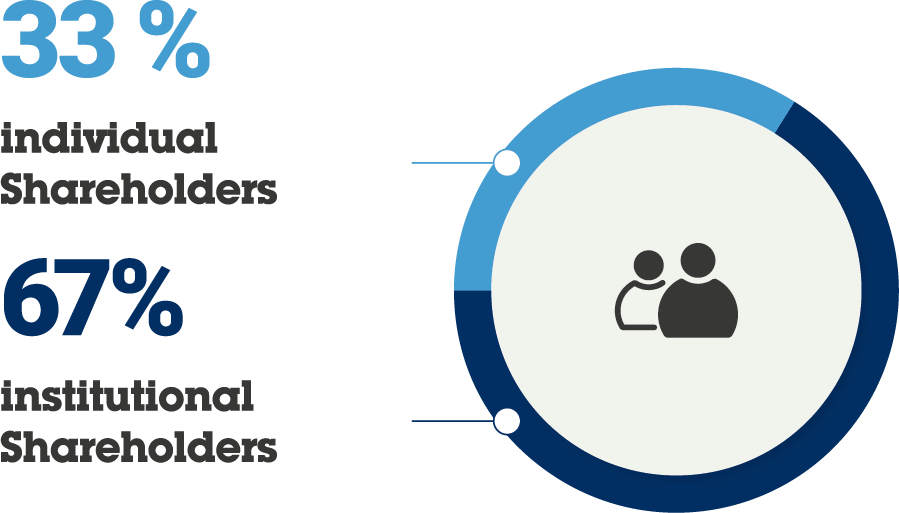

Profitable and sustainable growth over the long run is impossible without a clear, stable and identified Shareholder base. We have by far the largest proportion of individual Shareholders in the CAC 40, at 33%. Many of these Shareholders have trusted us for years and pass their shares on to their children. The Group’s strength is reflected in excellent long-run returns for Shareholders, with the 20-yr TSR(1) standing at 12%. We reward our Shareholders by offering them +10% on the amount of dividends and +10% on the number of free shares distributed during the allocation operations. We also promote dialogue, transparency and close ties to our individual Shareholders, particularly through the Shareholders’ Communication Committee (SCC).

A successful long-run strategy is impossible without a clear, stable and identified Shareholder base.

GROUP SHAREHOLDERS

NUMBER OF INDIVIDUAL SHAREHOLDERS

900, 000

Including :

- 140,000 direct registered Shareholders

- 230,000 intermediary registered Shareholders

- 530,000 bearer Shareholders

MARKET CAPITALIZATION

€100bnBy crossing this symbolic threshold on March 6, 2024, the Group became one of the top eight companies in the CAC 40 index by market cap

OPERATING MARGIN

+460bpsover five years is the Group's new operating margin ambition for the period 2022-2026