SUCCESSFUL GREEN BOND ISSUANCES TO FINANCE THE ENERGY TRANSITION

Three years after its inaugural green bond issue, the Group conducted new issues in 2024 and 2025, illustrating its determination to pair growth with sustainability. For each operation € 500 million were raised under competitive financial conditions and will enable the Group to finance flagship projects in low-carbon hydrogen, CO2 capture, and low-carbon air gases.

€ 500M

were raised through each green bond issuance, which attracted significant investor interest.

HISTORIC INVESTMENT PROJECT TO CREATE A LOW-CARBON GAS PLATFORM IN TEXAS

The Group has been selected to build a low-carbon industrial gas platform as part of ExxonMobil’s low-carbon hydrogen production project in Baytown, Texas. Pending the final investment decision, Air Liquide would build, own, and operate four large modular air separation units capable of producing 9,000 metric tons of oxygen a day, a significant volume, while reducing the production-related carbon footprint by two-thirds. The future units will also supply up to 6,500 metric tons of nitrogen a day as well as large volumes of argon, krypton, and xenon, enabling the Group to bolster its offering on the rare gases market.

$ 850M

in total could be invested, making this the largest industrial investment in Air Liquide’s history.

⤷Read more about this project on p.26

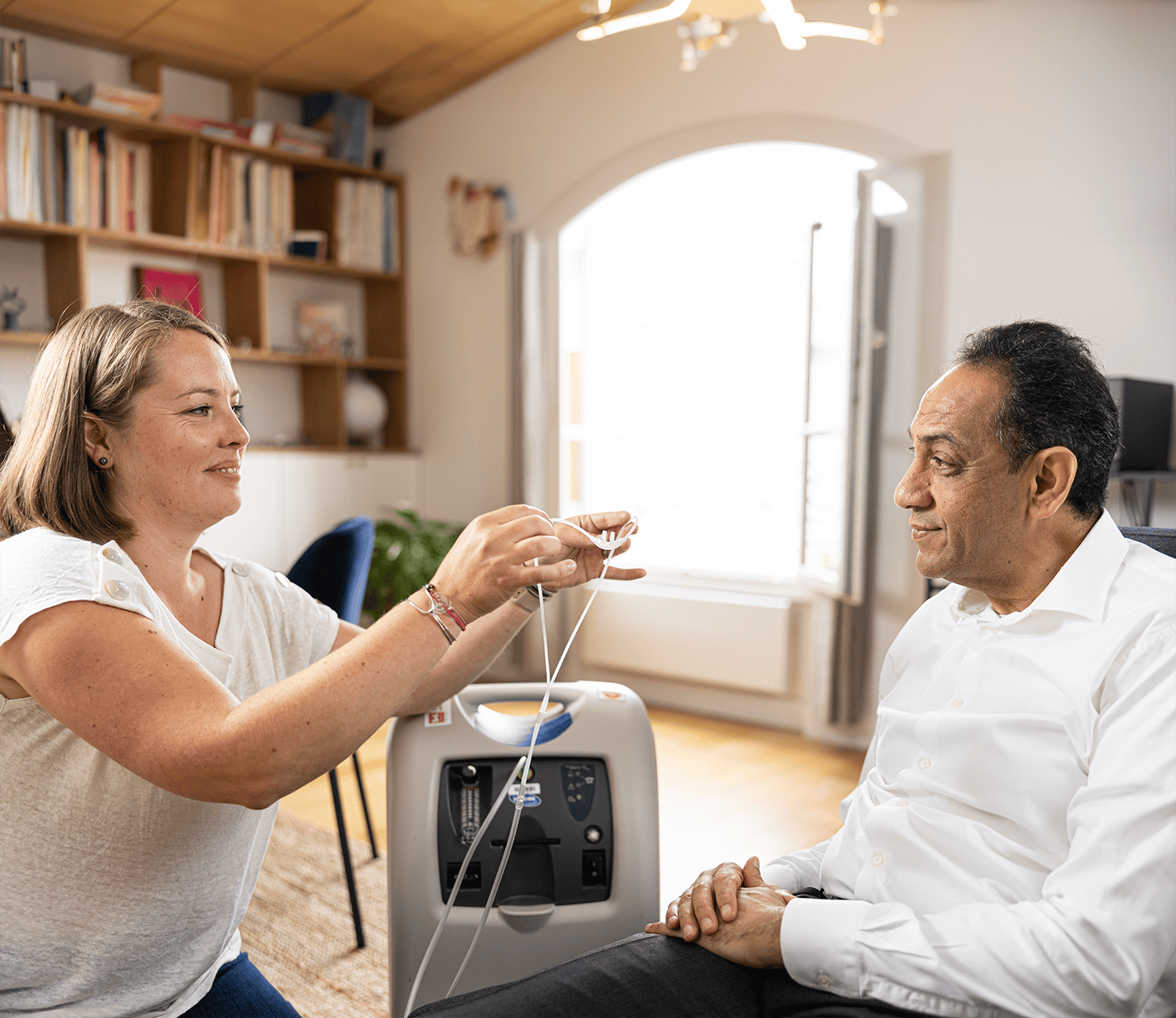

THE HOME HEALTHCARE ACTIVITY STRENGTHENED IN EUROPE

Two acquisitions, one in Belgium and one in the Netherlands, will enable Air Liquide to continue expanding its Home Healthcare activities in Europe. The newly acquired entities deliver home support to 10,000 patients living with respiratory insufficiency or sleep apnea, or requiring infusion or nutrition treatments. Through these acquisitions, the Group is strengthening its presence and broadening its infusion services in both countries. Worldwide, Air Liquide already provides home healthcare to 2 million people living with chronic illnesses and has made Home Healthcare one of its strategic development priorities.

2M patients worldwide including

10,000 new patients supported by Air Liquide in Belgium and the Netherlands.

SUPPORT FROM THE EUROPEAN UNION FOR THED’ARTAGNAN CO₂ INFRASTRUCTURE INITIATIVE

Air Liquide and Dunkerque LNG, which operates the LNG terminal in Dunkirk, France, have received support from the European Union to build CO2 transportation and export infrastructure. The aim is to reduce the carbon emissions of the Dunkirk industrial basin in the north of France. The infrastructure will include a pipeline to transport CO2 from capture facilities to the terminal at the port of Dunkirk, where it will be liquefied and loaded onto ships. D’Artagnan will receive a grant of more than €160 million through the Connecting Europe Facility for Energy funding program if the project goes ahead.

1.5Mt

of CO2 a year will be handled by the new infrastructure. This will ultimately climb to up to 4 million tonnes annually, which is equivalent to more than 5% of French industry’s greenhouse gas emissions.

EVOLUTION OF THE GROUP’S GOVERNANCE TO FOSTER AGILITY AND PERFORMANCE

Air Liquide is simplifying its organization to respond more effectively to new market requirements. Several changes have been made to the Executive Committee, including the appointment of David Prinselaar to head the Group’s new single worldwide Industrial Direction. Adam Peters, CEO for North America, has also joined the Executive team in 2024.

⤷Read more about the Executive Committee on p.44