FACTSHEET 12

Understanding THE STOCK MARKET

How does the stock market work?

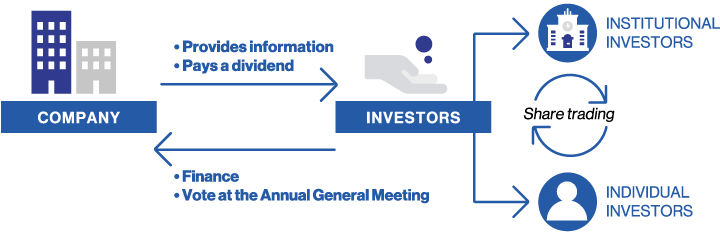

The stock market is a regulated market that brings together companies with funding requirements and investors, including individual investors. Shares are bought or sold through a stock order.

The company provides information and pays a dividend to investors.

The investors finance and vote at the Annual General Meeting.

The institutional investors and the individual investors share trading between them.

When a company wishes to diversify its financing sources and raise additional funds, it can decide to be listed on the stock exchange; in other words to issue shares on the stock market for the first time, or carry out a capital increase if it is already listed.

The primary market is therefore the “new market” where shares are listed for the first time, at a price set by the issuer, according in particular to market conditions.

When investors have confidence in a company’s ability to thrive and want to grow their savings, they buy shares which represent a fraction of this company’s capital. By financing the company in this way, they become co-owners and accept the associated risks and potential gains. In exchange for this acquisition, the company has a duty of transparency and provides shareholders with information regarding its “financial health” and strategy, thus allowing them to make informed investment decisions. Investors also have a sayin the company’s major decisions by voting at the Annual General Meeting, and receive dividends which are based on the company’s profit: this is the investment’s yield.

The shares of listed companies are liquid, i.e. once acquired, investors can freely exchange them on the secondary market (“second hand market”). The offsetting of supply and demand for these shares contributes to the setting of their stock market price, i.e. their unit price. If buyers’ demand exceeds sellers’ offer, the share price increases. If sellers’ offer exceeds buyers’ demand, the share price drops.

The stock market therefore plays a key role within the economy as companies rely on it for a part of the capital required for their investments and thus for their growth.

THE CAC 40

The CAC 40 (Cotation Assistée en Continu or Continuous Assisted Quotation) is the bench mark index of the French market. It measures the share price performance of 40 companies on the Paris Stock Exchange. CAC 40 stocks are selected according to their market capitalization and their free float, i.e. the share of their capital open to the public and traded on the stock exchange. At December 31, 2021, Air Liquide was the sixth largest market capitalization of the CAC 40 index, with a market cap of 72,872 million euros and 100% free float.